Business Services

Business Services

QuickBooks Training

Although QuickBooks is designed for the layman to understand, the initial setup and installation must be done correctly in order for future information to be accurate. All information necessary to setup manual accounting records is also necessary to setup and install QuickBooks on your desktop. This task is even more complicated if you switch from manual accounting operations to QuickBooks in the middle of the year. Which accounting method will you use? What chart of accounts do you need for your business? How do you handle beginning balances? An expert can easily answer all... (click for more)

Peachtree Training

Trying to decode online tutorials, tips, or training videos can be confusing. Let a one-on-one meeting with our professionals help you with your Peachtree program issues. We're happy to share our knowledge.

Business Planning

A strategic business plan is much more than a tool to obtain financing. If you still have all your plans and ideas locked up inside your head... preparing a strategic plan helps you clarify your company's direction, ensures your key leaders are all "on the same page", and keeps both management and staff focused on the tasks at hand.

A strategic plan is often needed when...

-

Starting a new venture, product, or service

-

Expanding a current organization, product, or service

-

Buying a new business, product, or service

- Turning around a declining business

The Strategic... (click for more)

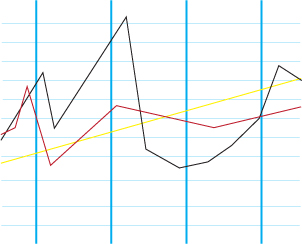

Cashflow Projections

"It's all about the cash!" -Ickes CPA

A wise business owner once said, "Happiness is a positive cash flow." As a business owner, I'm sure you agree. Everything is better when your cash-in exceeds your cash-out. A cash crisis can be emotionally devastating and it can even kill your business. If you've ever had to beg, borrow, and steal to cover tomorrows payroll you know what I mean.

Our cash management service allows you to...

-

know when, where, and how your cash needs will occur

-

know what the best sources are for meeting your additional cash needs

- be prepared to meet... (click for more)

Compliance Reviews

A Review is less extensive than an audit, but more involved than a compilation, a review engagement consists primarily of analytical procedures we apply to the financial statements, and various inquiries we make of your company's management team. If the financial statements or supporting information appear inconsistent or otherwise questionable, we may need to perform additional procedures. A review doesn't require us to study and evaluate your company's internal controls or verify data with third parties or physically inspect assets. Rather, a review report expresses limited... (click for more)

Business Audits

Stockholders, creditors, and private investors often need assurance that the financial statements accurately represent the true financial position of a company. Your stockholders, creditors, or private investors have different levels of risk tolerance, so we provide three levels of assurance to meet your needs.

Audit - Highest Level of Assurance

An audit provides the highest level of assurance. An audit is a methodical review and objective examination of the financial statements, including the verification of specific information as determined by the auditor or as established by general... (click for more)

Bookkeeping

As a small business owner you have more important things to do than to keep your own books. We take care of your books for you, so you can get back to the job of running your business and generating profits!

Each month or quarter we'll do the following things for you...

- Reconcile your bank account

- Generate an income statement

- Generate a balance sheet

- Clean up your general ledger

- Provide unlimited consultations

These tasks form the solid foundation of your small business accounting system. You can customize the package of services you receive by adding payroll, tax planning,... (click for more)

Payroll

Why Outsource Your Payroll...

- It's Cost Effective

Use ... (click for more)

IRS Filings

"The hardest thing to understand in the world is income taxes." - Albert Einstein

Knowing all the rules in filing taxes can be time consuming and confusing, let us handle those needs for your business. We can help you determine the best option for your circumstances and how to proceed next to best benefit your company.

Individual Services

Individual Services

Estate Planning/Management

Estate planning on your own can be complicated and costly. And the list is endless... state taxes, bureaucracy, probate courts, unfair appraisals, health care concerns, eligibility of heirs, life insurance, IRA's, 401K's, annuities, burial or cremation costs, and intent regarding death-postponing treatment to name a few. Not knowing your legal and financial rights often ends up costing you more in the end. Thoughts of estate planning often bring more questions than answers: Could an heir be too young to inherit? Should the inheritance be given at a certain age? Is the intended... (click for more)

Financial Planning

Financial Planning is utilized for short and long term goals such as:

- monthly expenses and budgets

- eliminating debt

- starting a new business or non-profit

- saving for a large purchase (buying a house, a long vacation, etc.)

- preparing for children's college funds

- saving for retirement

- and more...

Each scenario has its own important steps or instructions to follow to acheive your necessary goal. No matter the reason, let us help you plan for that next step in your life.